Posted July 01, 2024

By Sean Ring

Bitcoin to $100,000?

June 2024 Monthly Asset Class Report

I was really disappointed when Jay Powell didn’t man up and cut rates this past month.

Never mind, there’s a far bigger story brewing in the markets.

Finally, after years of crypto bros drooling all over their keyboards and making asses of themselves online, I will claim Bitcoin will hit $100,000 in the next 18 months.

That’s right. By January 2026 – I’m giving myself until December 31, 2025—Bitcoin will hit six figures. There will be no living with crypto bros. Michael Saylor, Saifedean Ammous, The Winklevosses… all of them will be unimaginably rich and smug as all hell.

But that doesn’t mean there aren’t other opportunities.

Gold and silver will still rally to the moon. And what’s more, stocks and bonds look good right now.

Why is that?

I think it’s because the markets think Trump will be President in January 2025. There will be no war with Russia or China, and Israel will have to cut a peace deal. Without the war premium, most overcooked assets will cool off.

But here’s the thing: if the real estate mogul-in-chief keeps Biden’s fiscal spigot open, and he almost certainly will, and the Fed chief is somewhat more accommodative with rates, we’ll have another everything rally during his term.

Stocks look good now—the charts even like bonds. But imagine gold, silver, and crypto with lower rates and reckless spending! To the moon, as the kids say!

We still target 6,000 for the SPX, $3,000 for gold, and $50 for silver. All of which can make you unfathomably rich.

But a $100,000 Bitcoin and a $6,000 Ether? Hoowee, that’s some party the USG is throwing… right after they throw Bumblin’ Biden under the bus.

To the charts!

S&P 500

***New Closing High of 5,460.48.***

Do you really want to call the top now? I certainly don’t.

We’ve had new monthly closing highs for 9 of the last 12 months.

Sure, we may have a pullback, which would be healthy. But a big sell-off?

It’s not impossible, but there’s nothing on the charts to indicate it’s likely.

Nasdaq Composite

***New Monthly Closing Record of 17,732.60.***

For the Nazzie, 8 of the last 12 months have resulted in new record-high closes. Market commentators are moaning about NVDA carrying the index and that the top 5 stocks are 21% of the index.

My question is, “Who gives a toss?” If we’re ascending to new highs, thank the goddess Fortuna, count your money, and shut your pie-hole.

I’m certainly not calling a top here.

Russell 2000 (Small caps)

The Russell’s strength confirms what we’re seeing in the major indexes.

It’s not shooting the lights out. But it’s not driving off a cliff, either.

I’m not a seller here… yet.

The US 10-Year Yield

This chart looks like it’s rolling over. Of course, after Biden’s disastrous performance in the debate last Thursday night, the 10-year popped up. I think this is temporary.

The Fed will likely cut in July now (though I was wrong about the June cut).

Even so, that’ll goose the markets as the USD follows the 10-year down.

Dollar Index

Here, I see higher highs and higher lows, which contradicts my story about the 10-year yield.

If we break above 107, there’s nothing between there and 111.50. Above there, it’s 114.

For those dollar bears – and there are compelling reasons to be one – my question is this: what’s the dollar going to fall against? The euro? Please. The sterling? Come on. The yen? You’re dreaming.

The dollar can only fall if the currencies it trades against rise. What currencies would you rather own? The dollar is still the prettiest girl in the ugly parade.

USG Bonds

My entire bond story has changed. I don’t like them, and inflation is making a comeback, but the charts are telling me a different story.

We’re up over a point from last month. But we’re either going to resume the downtrend or break out into a new uptrend.

My money is on the uptrend. Once we break 99, I’m looking for 104.

Investment Grade Bonds

We had a bad last week, but the month was positive overall.

If we clear 109, we can retest the 132 level. Scary, but possible.

High Yield Bonds

Junk continues its ascent. I’m looking at 79 as the next upside target.

Real Estate

It barely moved this month. It could be a bad omen. But there’s not much volatility here, either.

If you’re betting on the downside, 70 is the next big target.

Energy: West Texas Intermediate (Oil)

I got this totally wrong. Oil had a great month. I’m still not convinced, though. The world economy mustn’t be doing that great if we’re still only breaking $80.

Still, with this break upward here, the next big target is $100. But first, 88, then 92.

Base Metals: Copper

I was much better on this one, though we haven’t hit 4.30 just yet.

We’re in no man’s land right now. For copper to achieve new upside targets, we need to break $5.00 again.

Until then, we’ve got big downside targets, first to 3.70.

Precious Metals: Gold

From two months ago (and remains relevant):

$2,609 is our new target, but it may take a few months to get there.

The yellow metal’s price detail shows a nice consolidation between 2300 and 2450.

However, if we break below $2,300, we could head to $2,230 before restarting higher.

Precious Metals: Silver

Silver is still hanging around $30.

I see a $35.65 price target to the upside.

If we clear that, silver miner stocks will take off and we’ll see a move towards $50.

Cryptos: Bitcoin

Ok, when Bitcoin traded down to $16,000 and then caught its breath, I said we could see a $48,000 coin. I was right about that.

Here’s another one: if BTC stays above $55,000, we’ll see that $100,000 coin the crypto bros have been talking about for so long.

Cryptos: Ether

Like BTC, even after a subpar month, ETH is starting its new ascent.

The new upside target is $5,950. Crypto bros be celebrating soon.

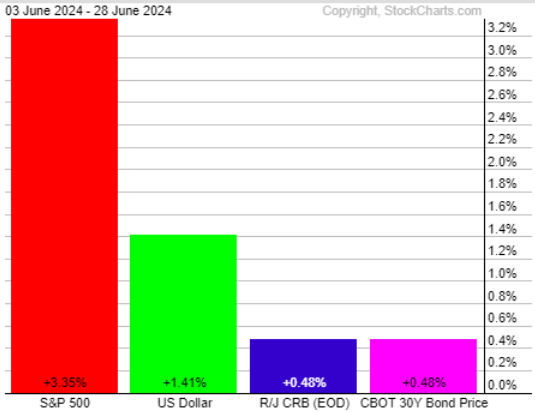

Trad Asset Class Summary

This was an “everyone wins” month. The dollar was up 1.41%, but that didn’t stop stocks, commodities, and bonds from finishing up for the month.

Stocks won bigly again, with the SPX up 3.35%. Commodities and bonds performed the statistically impossible feat of both finishing up 0.48%.

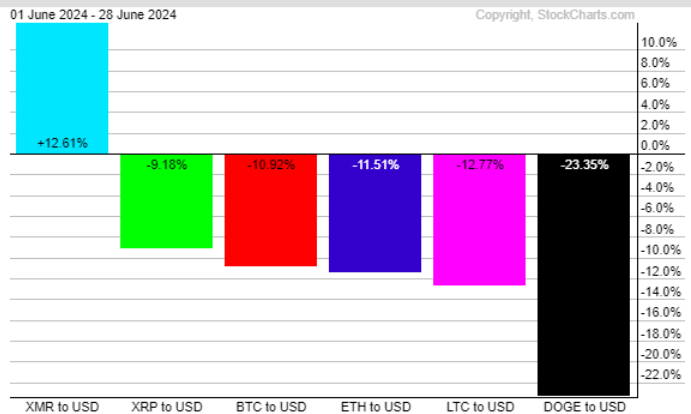

Crypto Class Summary

Big difference from last month, when almost everything was up.

This month, only Monero, the most secretive coin, made any headway. The rest of the big coins stunk up the place, with Dogecoin, Elon’s fave, losing nearly 25%.

Bitcoin was down nearly 11%, and Ethereum was down 11.5%. But it doesn’t matter… they will rise again soon.

Wrap Up

Get ready for the mother of all rallies. It’s coming, despite the naysayers. And a weaker dollar? Fine by us. But it’s got to get weaker than the Bud Light-like euro, sterling, and yen.

Still, stocks, bonds, crypto, and commodities are all looking positive on the whole.

There will be a time to get short. But it is not this day.

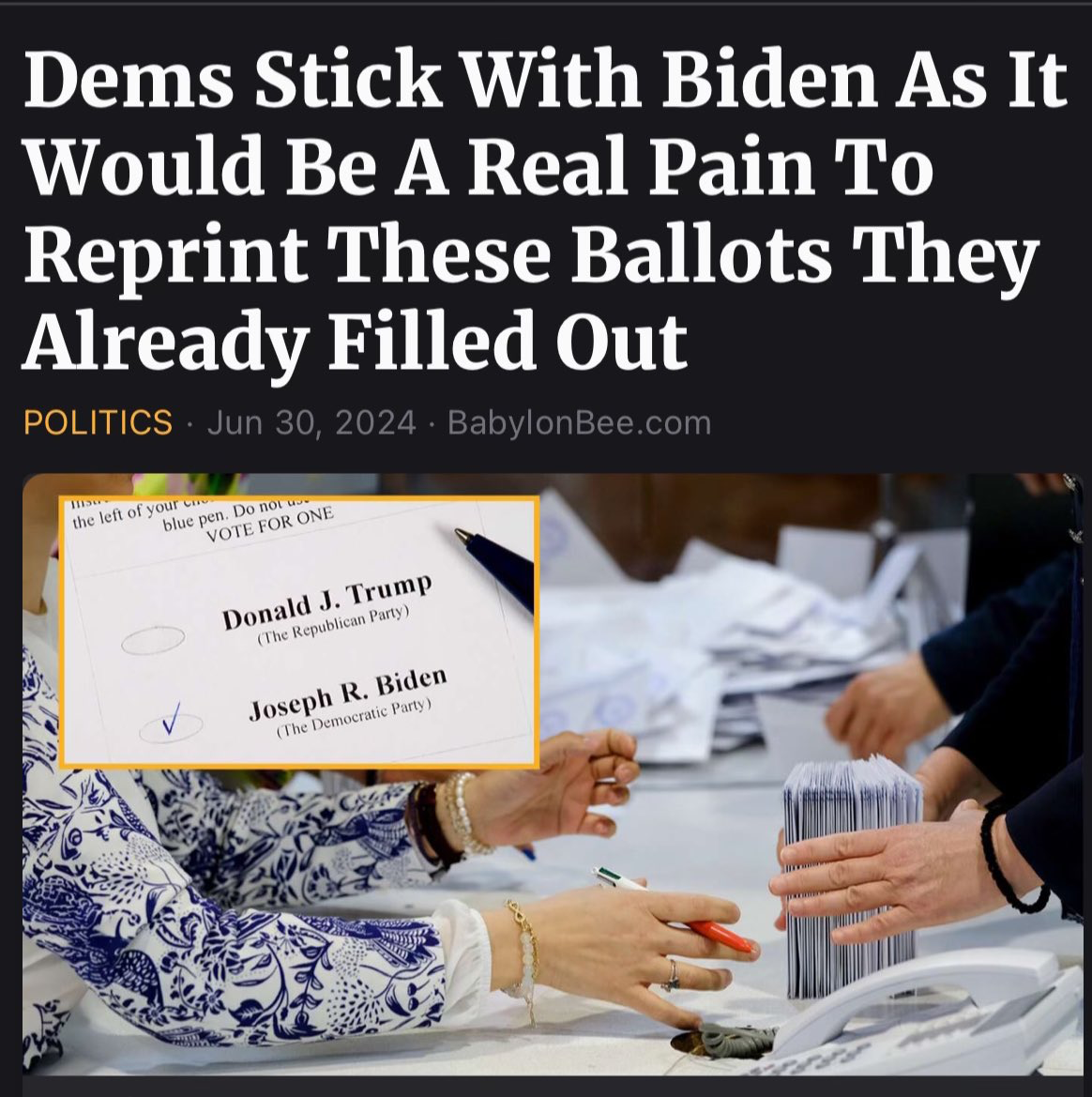

Finally, let’s take a moment, courtesy of the Twitterverse:

Have a wonderful week!

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring

Beware of Flying Turkeys

Posted February 23, 2026

By Matt Badiali