Posted March 13, 2023

By Sean Ring

Be Angry. Yes, This is a Bailout. Yes, You’re Paying for It.

- The Fed, Treasury, and FDIC have bailed out Silicon Valley Bank depositors. Or…

- The Fed, Treasury, and FDIC have thrown the US taxpayer under the bus.

- No matter how you slice it, the tax parasites in DC are making you pay for this.

Good morning on this overcast morning in Northern Italy.

To paraphrase Popeye, I’m utterly disgustipated on your behalf.

Whether by inflation or bank fees, you’re about to get poorer through no fault of your own.

Jerome “Transitory” Powell, Janet “There won’t be another crisis in my lifetime” Yellen, and the FDIC - from now on pronounced “F-DICK” - have conspired to make you bail out Oprah, Meghan and Harry, and Nancy and Paul Pelosi.

Yes, they’re all going to be fine, thanks to the unholy tripartite alliance, much to your detriment.

In this piece, I may commit the sin of oversimplifying things. But it will make it easier for you to understand the overall concepts. That’s more important than getting caught in the weeds of detail.

For more detail, I can’t encourage you enough to read my friend and colleague Dan Amoss’s report “It’s Not A Wonderful Life In Silicon Valley.” If you’re a Strategic Intelligence subscriber, it’ll already be in your inbox.

In today’s Rude, I borrowed liberally from Dan’s work. Thanks, Dan!

What Happened?

First, let’s establish why even Treasury bonds are a risky investment in a rising rate environment.

US treasury bonds are default risk-free, not price risk-free.

That is, the US Treasury can print whatever money it needs to make its investors whole. So it will never default on its debts.

But USTs certainly have price risk! Just look at the ETF known as the TLT, which holds long-dated Treasury bonds:

Just eyeballing this chart, you can see the TLT fell from a peak of about $150 to a trough of about $92.50.

That’s a 38% loss!

Not very risk-free, is it?

But that’s what too many investors think.

And that leads to enormous problems.

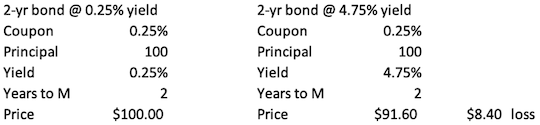

Let’s look at an example of how bond prices move. In this case, we’ll use a 2-year bond with a coupon of 0.25% to match the initial upper bound on the fed funds rate.

At issue, the bond will be priced at “par.” That means the issue price will be $100 (left-hand side). I’m using 100 as the principal instead of 1,000 - the usual UST face value - so you can see the percentage changes more easily.

Now let’s raise rates to 4.75%, as our dear chairman did. All else equal, our bond is now worth $91.60, a loss of $8.40. (Of course, that didn’t happen all at once. But we’re keeping this simple.)

That loss feeds directly into the income statement, which feeds into the equity section of the balance sheet.

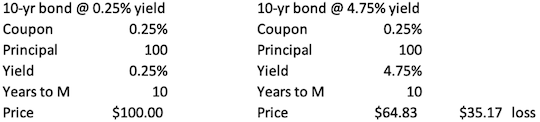

But that’s only a two-year bond. What happens with a ten-year bond?

It’s much worse of a loss!

Why? Because the bond is of a longer duration. Longer-dated bonds are far more susceptible to interest rate hikes than short-term bonds.

The loss is now $35.17 when we go from a 0.25% upper rate bound to a 4.75% upper rate bound.

The mathematics are deceptive. Powell didn’t raise rates by 4.50% (4.75% - 0.25%). He raised rates 18x (4.75% / 0.25% - 1). You must look at the change, and not the difference, to grasp how much he’s increased rates.

These banks - most US banks - are loaded with Treasury paper thanks to Basel III’s requirement to hold HQLA (high-quality liquid assets).

“But Sean,” you say, “what else could they have done?”

And the answer is easy - or should be - with CFOs.

Buy interest rate swaps (payer swaps) to hedge your interest rate risk.

And it’s amazing, but Silly Valley Bank didn’t do that!

Why Were These Losses So Needless?

Because big banks will charge only a small spread to trade interest rate swaps.

This should have happened: every time the SIVB CFO bought a long-duration, low-coupon bond, she should’ve immediately called JP Morgan, Goldman Sachs, or Bank of America to do a swap.

The entire package would have looked something like this:

Credit: Sean Ring

Ok, the UST is paying SIVB a 0.25% coupon. It’s fixed. There’s nothing you can do about that.

But… you call up one of the big banks and swap out that 0.25% for a floating rate (either SOFR or USD LIBOR nowadays).

The 0.25% “legs” cancel each other out, and SIVB would’ve been left with receiving a floating rate (minus the small spread).

In this standard, everyday scenario for most banks worldwide, they’re now protected from rising rates. What they would inevitably lose on the bond will be made up by the SOFR/LIBOR leg of the swap.

That’s how you immunize yourself from interest rate risk. It’s so damn simple what little hair I had on my head just fell out!

It’s so common that according to the Bank of International Settlements, there are about $10 trillion in net notional interest rate swaps outstanding.

Fancy Some Whine?

Greg Becker, the CEO, was a member of the San Francisco Fed. Daniel Beck, the CFO, is a Freddie Mac veteran. Phil Cox, the COO, was at the bailed-out RBS for 23 years.

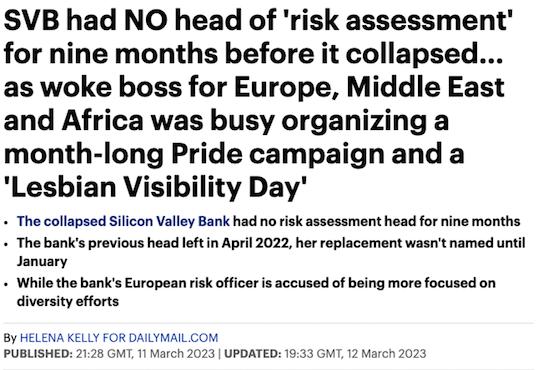

Oh, it gets better:

Credit: The Daily Mail

That’s not so much a Board as a “Rogue’s Gallery.”

But with no head of risk for that long, who’s minding the bond book?

Answer: No one.

And who’s paying for these boneheads’ mistakes?

You are.

Why? Because people like Bill Ackman and David Sacks scared the shit out of Biden’s government.

The Bailout

The gov’t has about 48 hours to fix a-soon-to-be-irreversible mistake. By allowing @SVB_Financial to fail without protecting all depositors, the world has woken up to what an uninsured deposit is — an unsecured illiquid claim on a failed bank. Absent @jpmorgan @citi or @BankofAmerica acquiring SVB before the open on Monday, a prospect I believe to be unlikely, or the gov’t guaranteeing all of SVB’s deposits, the giant sucking sound you will hear will be the withdrawal of substantially all uninsured deposits from all but the ‘systemically important banks’ (SIBs)...

It’s ridiculous.

Sure, there would have been fallout. But sometimes, that’s exactly what you need to fix the system.

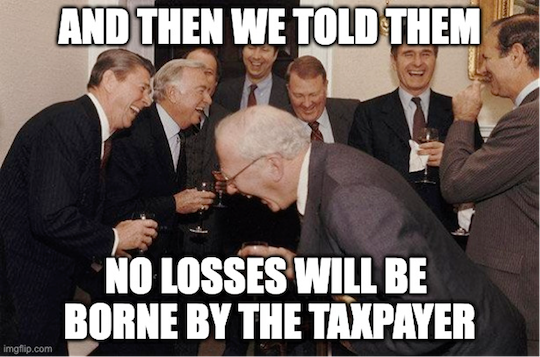

Of course, the government says there will be no taxpayer-funded bailout. Well, it’s not direct, but it’s a bailout. And it’s taxpayer-funded.

The Joint Statement reads (bolds mine):

After receiving a recommendation from the boards of the FDIC and the Federal Reserve, and consulting with the President, Secretary Yellen approved actions enabling the FDIC to complete its resolution of Silicon Valley Bank, Santa Clara, California, in a manner that fully protects all depositors. Depositors will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

We are also announcing a similar systemic risk exception for Signature Bank, New York, New York, which was closed today by its state chartering authority. All depositors of this institution will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.

Shareholders and certain unsecured debtholders will not be protected. Senior management has also been removed. Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law.

Ok, so the owners aren’t getting protected. So it’s technically not a bailout in the traditional sense.

But depositors’ funds over $250,000 are getting bailed out. And how?

By a “special assessment” on banks. And who ultimately pays for that?

You. With your fees and commissions and anything else you pay your bank.

And you are a taxpayer, are you not?

As James Bond said in Goldeneye, “Governments change, but the lies stay the same.”

Wrap Up

Gold is up. Bitcoin is up.

Oddly enough, stock futures are flat to down as I write.

Bailouts have unintended consequences. This one will be no different.

In your spare time, I can’t encourage you enough to read our 2023 Daily Reckoning Gold Buying Guide.

I hope it helps you in times like these.

How Options Boss Stocks

Posted February 20, 2026

By Nick Riso

Investing is So Taxing!

Posted February 19, 2026

By Sean Ring

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring