Posted March 01, 2024

By Sean Ring

Back to the Future with “AI.com”

February 2024 Monthly Asset Class Report

Remember in the late 90s when every company started adding “.com” to their official title?

All those companies shot to the moon by March 2000, only to crash down to earth once the NASDAQ crash came a tumbling.

We’re in the upward lift of a new melt-up led by companies who’ve convinced the market they’re “AI-driven.”

And that’s just fine by us.

Because the NASDAQ made roughly 30% in the last leg of that crazy rally.

Yesterday, the Nazzie hit a new all-time high, its first since 2021. And we have a long way to go before this rally fizzles.

And remember, the Fed will still almost certainly cut rates in the middle of the year.

Since Americans - especially Democrats - think this next election is between life and death, the Powell Put may be more important than the Greenspan Put ever was.

Sure, there will come a time to lay your cards down and quit this unholy game of poker. But as Aragorn once said, “It is not this day.”

Since this is all quite inflationary, Bitcoin and Ether popped hard, with Bitcoin near its all-time high. The rest of the crypto space is doing well also, with some altcoins returning over 100% in the last quarter.

Gold has closed above $2,000 for the last four months. We’ve found our new floor and launchpad for the next rally to $3,000.

Silver has been a yawn but won’t wake up until gold does. As Rick Rule says, “First fear, then greed.”

Let’s see if oil can escape its holding pattern and rally.

With that in mind, let’s get to the charts.

S&P 500

Looking at this chart, there’s no reason in the world to be short.

We may take a breather in the coming weeks, but I’d still participate in this rally.

The long-term target remains 6,000.

Nasdaq Composite

***NEW MONTHLY CLOSE RECORD OF 16,091.92***

The markets shrugged off last month’s end-of-month sell-off.

Again, NVDA shows no sign of slowing down, healthy or not. The MAG 7 keeps plugging away.

The long-term target is 17,350.

Russell 2000 (Small caps)

We bounced off the 50-day moving average last month, rallying from 192 to 203.

I’m leaning bullish here. If the Russell takes off, that’ll put an exclamation mark on the broader and bigger market rallies.

The US 10-Year Yield

I got this wrong last month. The 10Y increased 26 bps to 4.25%.

And yet, the market shrugged this off.

Tough to tell: the next FOMC meeting is at the end of March.

Dollar Index

I was looking for the next target of 105.5, followed by 106.5.

But we may have topped out here.

Indeed, this could be the beginning of another dollar plunge.

I’d look for 101, followed by 99.5.

USG Bonds

It was a dull month, with TLT dropping only 2 points to 94.18.

It may remain rangebound, but the best guess at the next target is 90.

Investment Grade Bonds

We fell a few more points to 107.66 (from 110).

I imagine it’ll stay rangebound but maybe get down to the 106-105 area.

High Yield Bonds

It can’t seem to get over the 77.50 hump. The upside target is in the 90s.

I’d still be wary of a minor reversal if we don’t see an upside breakout soon.

Real Estate

Put a hold on that reversal I called last month. We may be heading back up.

The first target is 89, then 94.

Energy: West Texas Intermediate (Oil)

We’re back to 78.26. Between Israel, Hamas, the Houthis, and the Suez being shut, I can’t believe we’re still under $80. That’s the best indication the world economy is weak.

Still, absent a universal peace, I can’t see this lasting. I’m looking at 83, at least.

Base Metals: Copper

Rangebound and boring. Until we break above 3.95 or below 3.55, there’s not much to be had here.

Precious Metals: Gold

The chart shows $2,054/oz. And it’s the fourth straight monthly close above $2,000!

I’m still bullish and think we’ll reach $3,000. But it will be a far more brutal slog than we imagined unless we get a surprise rate cut, which I can’t see happening.

Precious Metals: Silver

From last month:

Sideways Silver strikes again. There is nothing to report other than to hang on to your holdings. It’ll be worth it. We just need to get above $26 first.

Cryptos: Bitcoin

We blew through the target of $47,000. Now, we’re flirting with the ATHs.

Next stop: $66,500.

Cryptos: Ether

We blew through $2,820 all the way to $3,352.

For Ether, the sky’s the limit.

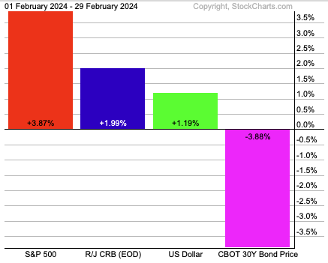

Trad Asset Class Summary

Stocks were up 3.87% this month.

Commodities finished second, with a 1.99% return.

Oddly enough, the dollar also finished positively, up 1.19%.

Bonds got trounced, losing 3.88%.

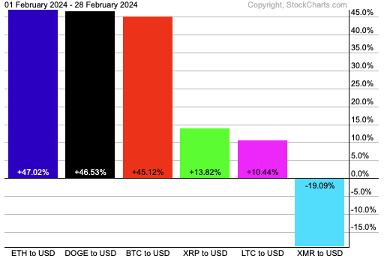

Crypto Class Summary

Ether, Dogecoin, and Bitcoinshot the lights out, returning over 45% each.

Ripple and Litecoin were up by double digits.

Monero was hammered, down nearly a fifth.

Wrap Up

Stocks, crypto, and gold. It’s a pretty simple formula.

May the rally continue until the morale improves.

Finally, let’s take a moment, courtesy of the Twitterverse:

Have a great weekend!

Don’t Sell Your Gold — Not Yet

Posted August 13, 2025

By Sean Ring

The Venice of Poland — With Better Beer

Posted August 12, 2025

By Sean Ring

Five Eyes Gets A Middle Finger

Posted August 11, 2025

By Sean Ring

“Smart… For Someone Who Doesn’t Have a PhD.”

Posted August 08, 2025

By Sean Ring

Trump’s Golden Bullet

Posted August 07, 2025

By Sean Ring