Posted December 14, 2023

By Sean Ring

Are You Ready For the 2024 Market Melt-Up?

Yesterday evening Eastern Time, the Paradigm Press 7 Predictions Summit was live on Zoom and YouTube.

I hope you joined us. Seeing my friends and colleagues and conversing with our incredibly loyal and charitable viewers was an absolute blast. To think people would stay with us for four hours delights me to the core.

Of course, of the over 7,000 people on the call, most wanted to hear Jim Rickards, James Altucher, Byron King, Zach Scheidt, Ray Blanco, and Greg Guenthner were predicting. Even an AI version of Alan Knuckman put in his four cents. (You never just get two from Ole Alan…)

But since you’re a stalwart Rude reader, you have every right to know my prediction. And here it is: Christmas is coming early… and it’ll stick around for a while.

The Prediction(s)

- The S&P 500 will reach at least 5,000 before selling off into the election.

- The higher the SPX goes before the cuts start, the likelier it’ll hit 5,000.

- Gold will reach $2,500 per oz. before August.

- Gold and gold mining stocks will finally take off, but only after the cuts start (Powell’s Pivot).

Although you’ll see more backup later, these are the only two targets I’m held to.

Two Big Cognitive Errors

Error Number One: We’ve consistently - over decades - underestimated the strength and resolve of The State.

Error Number Two is worse than that. It’s our constant overconfidence in “The People” to break free of the chains (they so clearly revere).

The lack of reaction to the March bank bailouts proves that case. The silence was deafening as Oprah, Harry, Megan, and Silicon Valley got its bailout. There was nothing similar on the cards for any of the flyover states. Of course, they usually don’t vote Democrat (without some help).

Axioms I’m Working From

This part is crucial because it’s the worldview I’m working from. Here are my “givens” or starting points to make this prediction.

- Jay Powell does NOT want to work for Donald Trump again.

- Joe Biden (or his Democratic handlers) want him or another anointed one (Newsom) to retain the Presidency for the Democrats.

- Jay Powell will tacitly agree to help the Democrats retain power.

- Jay Powell will start cutting rates (pivoting) at the latest possible moment.

- Donald Trump will cry foul. In fact, the more he cries foul, the more the strategy is working.

After Chairman Pow’s first experience with DJT, I’m sure he prefers The Husk Known As Joke Biden to be his boss.

No Fed Chairman is genuinely independent. The closest we had was Alan Greenspan during the Clinton years. Greenspan was arguably the most powerful man in the world during that time. Greenspan had, purposely or not, helped Clinton defeat George H. W. Bush in the presidential election of 1992. Clinton both respected and feared Greenspan.

But these aren’t those days. And that’s why I think Powell will quietly help Biden (or whoever the Democratic Nominee is) by cutting rates when the economy finally starts to catch up with the stock market.

Powell won’t make it obvious, so he’ll wait until the last moment to cut rates. This will goose the stock, bond, crypto, commodities, and real estate markets.

Trump will be screaming, “The game is rigged!” from the sidelines to no avail.

Will this turn the tide in the Democrats’ favor? It’s doubtful, but as long as you’re long during this political catfight, you’ll do just fine.

Interestingly, after last Friday’s jobs numbers, Biden showed the world exactly what he thinks of Fed independence:

Credit: Bloomberg

Waiting For Jerome…

Whenever you see the mugshots of the Big Four central bank heads on Bloomberg, you can be sure a crime is about to be committed.

Credit: Bloomberg

After the Nixon Shock (getting the US off the gold standard in 1971), then-US Treasury Secretary John Connolly said, “It may be our currency, but it’s your problem.”

Here’s the thing: The ECB, BOJ, and BOE cannot cut before the Fed because of capital flight worries.

By that, I mean if Powell wrongfoots everyone by hiking, and those central banks have already cut rates, money will fly out of Euroland, Japan, and the UK and into the US. Those countries can’t afford that to happen. (If the capital flight is big enough, it may create the very inflation Powell is desperate to avoid.)

Also, UST interest payments now exceed the annual defense budget. Yes, you read that right. After Social Security, the second largest line item in the US budget is interest. Then defense. It’s insane.

And, remember, Jay doesn’t want to work for The Donald again.

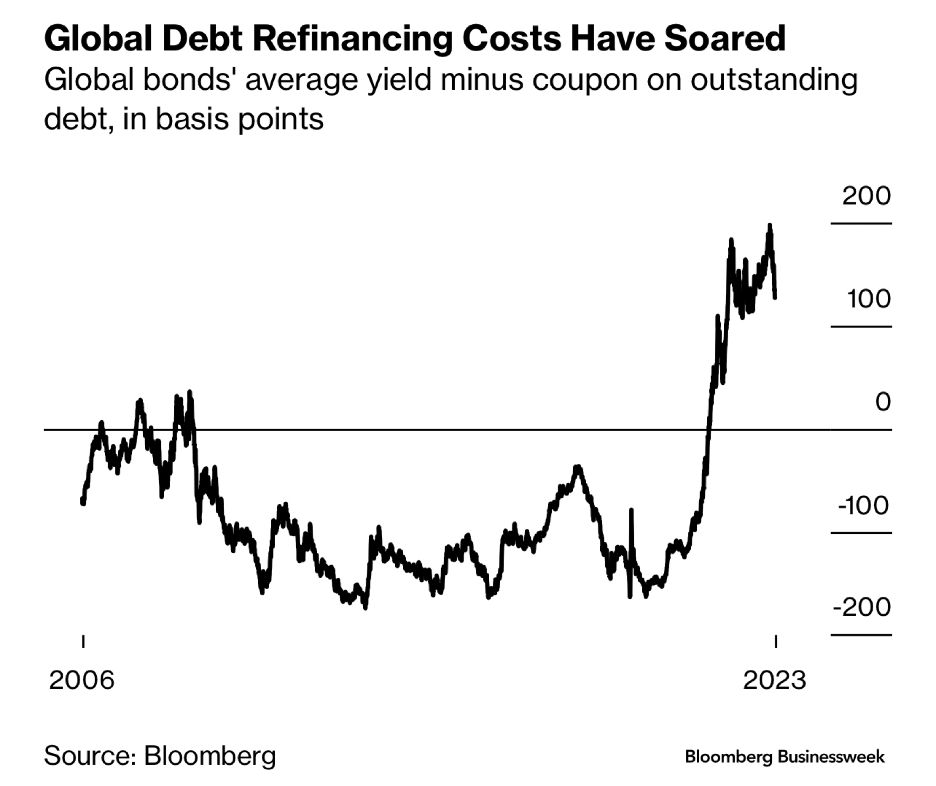

Refinancing Is Too Expensive Now

It’s not only governments who have to worry about high interest rates.

Most companies - any company not in the S&P top 150 - must roll over, or refinance, its debt at much higher rates than before.

Many of these companies simply can’t run at above-zero rates.

Of course, this bleeds to the consumer, who now faces high mortgage and credit card repayment rates.

Credit: Bloomberg

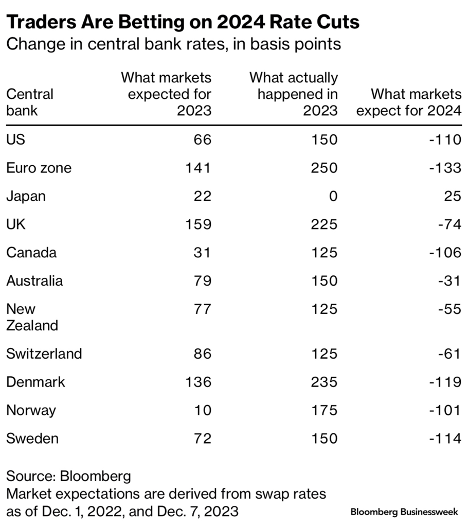

Wrong Last Year, Right This Year?

It’s almost hilarious how wrong the world’s traders got it last year.

Rates were hiked by much more than they expected.

The question is this: Will rates come down this year, and how much?

Credit: Bloomberg

I’m pretty sure they must, which only feeds into Jay Powell’s list of motivations to cut. But he’s a stubborn one!

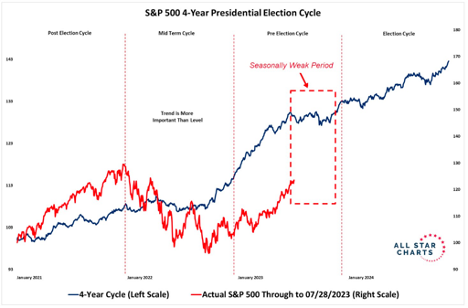

The Presidential Election Cycle

JC Parets at All-Star Charts put together this great chart at the end of July last year.

Credit: @allstarcharts

We’re in the “meh” period before the election cycle begins.

And I think our central bank will be doling out goodies to get his man back in the White House.

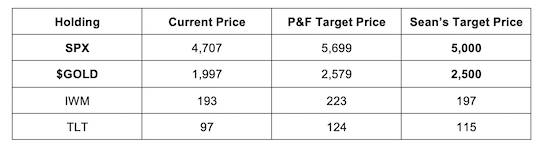

Price Targets For 2024

I use Point and Figure Charts to look at possible price targets. I won’t get into them, per se, as virtually no one uses them anymore.

However, they provide upside and downside targets that help evaluate the risk-reward of a trade.

And boy, are those targets bullish or what?

Not only are my SPX and $Gold predictions validated but they’re surpassed.

So, I’m very comfortable with my two predictions.

But to throw them in there, the Russell 2000 (IWM) and Long Treasury ETF (TLT) both look great.

Wrap Up

Predictions are a risky business. But I’m confident we’ll see a big rally into 2024 before things fall apart.

There’s such a disconnect between the real economy and the stock market it would be foolish to short now.

In fact, you want to be quite the opposite.

Have a great day.

The Curious Incident of the Dog in the Night-Time

Posted September 12, 2025

By Sean Ring

America’s Rubicon: Two Murders That Changed Everything

Posted September 11, 2025

By Sean Ring

Just a Tad… The BLS’s 911k Emergency

Posted September 10, 2025

By Sean Ring

Dollar Default in Digital Drag

Posted September 09, 2025

By Sean Ring

The Market Has Caught Up With Us!

Posted September 08, 2025

By Sean Ring