Posted February 05, 2026

By Sean Ring

ANNIHILATION!

Waking up to a 76-handle in silver was indeed a rude awakening. We briefly recovered to the low 80s, but we’re currently trading around 79, down over 10%.

I hate starting my day with a wince.

The night sessions have been nightmares for metals bulls, and no more so than for silver stackers. I thought we got through the volatility and were on our way to a bit of market civility over the coming weeks. I neither wanted nor needed a V-shaped recovery.

And while my friend and colleague Nick Riso gave a brilliant explanation for Friday’s sell-off in yesterday’s Rude, clearly, we’re not done with the metals monkeyhammering.

Why, oh why? I’ll try to parse together my thinking through this issue, but getting my head together over this is like herding cats.

Capital Rotation Event

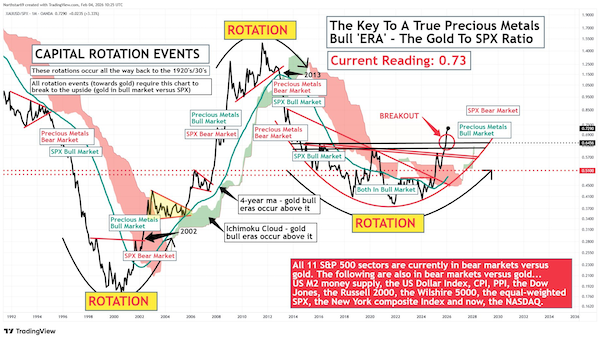

Massive credit is due to the gentlemen over at Northstar Charts, who called for a capital rotation event ages ago.

To remind you, the rotation is from stocks into precious metals. Below is their chart illustrating the long-term ratio between the two.

Credit: Northstar Charts

If this is happening, then why doesn’t it feel like it’s happening? Well, it did… until last Friday.

The road to riches never did run smooth, to paraphrase old Billy Wigglestick. And we’re going through the turbulence of a massive asset ownership shift.

Trump’s Metals Floor

If anything, whispers of a floor underneath metal prices should make bulls feel better, even if it induces the gag reflex for any free market thinker.

The problem: there is no floor in play.

The administration is shifting its critical minerals strategy from direct government-guaranteed price floors to a more systemic industrial policy approach. MP Materials was early (and lucky). That’s all.

This new direction uses "reference prices" within a proposed critical-minerals trade bloc. These prices would be protected against foreign (read: Chinese) dumping through adjustable tariffs.

The strategy also includes a range of supportive tools:

- Strategic stockpiles

- Long-term offtake contracts

- Loans and tax breaks

- Allied coordination

In effect, this creates an industrial policy "put" option for Western-aligned supply chains, instead of a Treasury-backed price floor for every project. While policy risk remains, we see the administration moving towards supporting capital expenditure in processing and in key minerals such as rare earths, lithium, nickel, and cobalt, all areas where China currently dominates.

In short, I agree with my friend and colleague Enrique Abeyta when he wrote, “If you’re a long-term holder, I would do nothing right now. The long-term bull case for silver remains strong. It’s impossible to know where prices are headed from here, but I wouldn’t be surprised to see silver go higher — much higher.”

But when it comes to mining stocks, we may have a different story. I’ll get to that later. But first, other asset classes and sectors are getting taken out behind the woodshed, as well.

Tech and Software

Claude is an amazing tool, and I’d love it even more if I were a coder. But I don’t think it’s going to replace all the software in the world.

This selloff in tech and software may be overcooked. But it also jibes with the capital rotation story. As you may recall, I got out of tech completely before The Donald won the election. I was early, for sure. But I’m not sure I was entirely wrong.

But even if I didn’t believe in the capital rotation story, would I buy here? I’m not into catching falling knives. First, I’d want to see a big up candle, like in the Spring of last year.

But this isn’t the only bit of tech having trouble right now.

Bitcoin

Michael Saylor’s mechanical personality may have saved him from Jeffrey Epstein. Now, he has to hope it saves him from the paper hands that hold Bitcoin.

This chart is ugly, and it’s heading to the next target of $55,500.

Unfortunately for the Bitcoin maximalists, BTC is acting like a technology stock with no end use. Or, as the naysayers love to spout, “It’s a solution to a problem that doesn’t exist.” And now that many think a foreign actor controls the asset, they’re dropping it like a bad habit.

USD: False Breakdown?

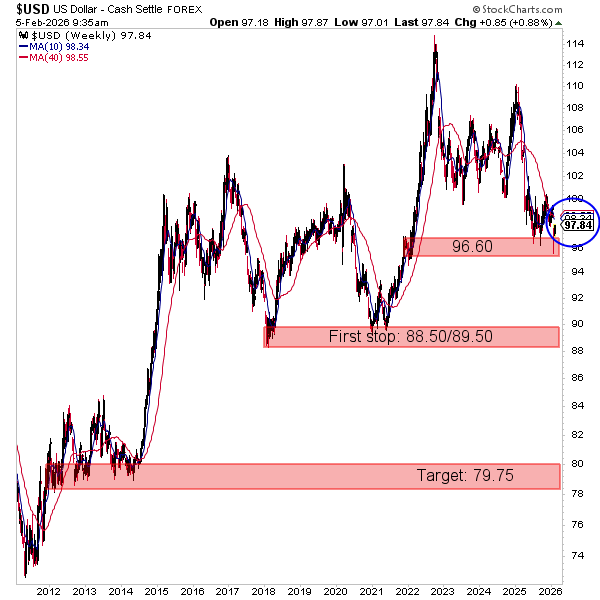

The dollar has unexpectedly recovered this week, after falling through the 96.60 level.

Last week, I was sure the USD was headed down to the 88.50/89.50 area. It may still do that. But it’s not a sure thing anymore.

The dollar moving up, likely because of Warsh’s nomination, is putting pressure on the precious metals.

Silver and Gold

First, silver. In short, if we close below $79 today, our next downside target will be around $37. It’s that bad.

As for gold, the situation isn’t as dire. But it’s not great, either. If we close below $4,640 - we’re at $4,870 as I write - then the next downside target will be around $3,490.

It’s important to understand these targets aren’t set in stone. But they give a good indication of what could happen should things get any worse.

What to do?

What I’m Doing

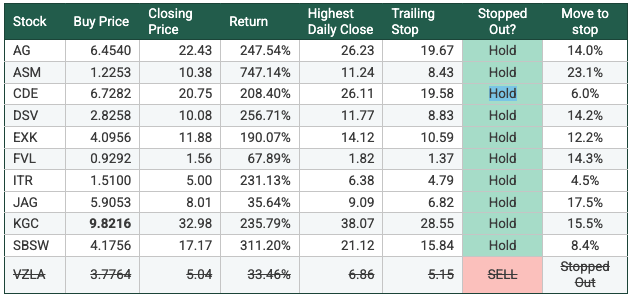

I’ve already been stopped out of Vizsla, and it’s a good thing, too. That stock is now trading far below my stop level. I will monitor the portfolio, and if any of these stocks close below the trailing stop level, I will sell them tomorrow. Of course, you’ll be the first to know about that. I won’t sell until you have time to get out first. (Integra Resources and Coeur look vulnerable.)

I’ve had a helluva ride so far. I don’t want to sacrifice all these gains for the sake of believing the metals will go higher.

Wrap Up

It’s another disaster day for the metals and a few other sectors of the markets, as well. Perhaps we’ll recover over the course of today’s session.

But now’s a time for caution, not ideology. We’re clearly not through the storm yet.

Vicious Patriotism

Posted March 05, 2026

By Sean Ring

Don’t Overprice Risk with Mining Companies

Posted March 04, 2026

By Matt Badiali

America First!

Posted March 03, 2026

By Sean Ring

WAR! What’s It Good For?

Posted March 02, 2026

By Sean Ring

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring