Posted September 06, 2023

By Sean Ring

Almighty Dollar Hammers Asia, Europe

- Asian central banks don’t want to hike, which weakens their bonds.

- China’s yuan and Japan’s yen have underperformed versus the USD.

- The BRICS’s plan wasn’t developed enough.

Happy Hump Day from a gloriously sunny Asti!

Yesterday, we broke down the dollar index, showing the basket’s constituents and performances and why it’s a good bet to be dollar-bullish.

It was a good exercise, and I hope you feel like you understand the US dollar index’s gears and cranks better.

And we were right on time.

Because this morning, stories of dollar dominance fill Bloomberg’s front page.

Don’t get me wrong: de-dollarization is a thing. It’s just going to take time. Perhaps lots of time.

As Hemingway once wrote, “Gradually. And then suddenly.”

In the meantime, flows are going through the USD. And it’s pretty easy to see why.

As the Fed hikes rates, the dollar becomes more attractive. And while most investors thought the rate hikes would end soon, it looks like they will wait longer.

In fact, while the market seems sure Chairman Pow won’t hike this September, I’m still not so sure. And even when he finally stops, there’s no guarantee that a “pivot” to rate cuts is around the corner.

In this edition of the Rude, we’ll get a bit more macro and geopolitical on the renewed almighty dollar.

Dollar Rises in the East.

From Bloomberg:

Japan issued its strongest warning in weeks against rapid declines in the yen on Wednesday, with its top currency official saying the nation is ready to take action amid speculative moves in the market. Shortly after, China’s central bank offered the most forceful guidance on record with its daily reference rate for the yuan, as the managed currency weakened toward a level unseen since 2007.

As these two countries are export-driven, they may be crying crocodile tears.

Nevertheless, as China and Japan still pay dollars on many of their imports, they may be starting to feel the pinch.

Bloomberg’s Asian dollar index has certainly underperformed:

Credit: Bloomberg

Again, from Bloomberg:

“The prospect of higher-for-longer US rates is reigniting pressure, and investors will be cautious,” said Vijay Kannan, a macro strategist at Societe Generale SA in Singapore. “Specifically, EM Asia is more vulnerable to this dollar strength, given a much lower interest rate differential and a greater exposure to a weaker China growth outlook.”

This is something we’ve been saying in the Rude for a while. Jay Powell won’t start cutting rates as soon as he’s done hiking, whenever that is.

And the market may be completely incorrect this time regarding the September meeting.

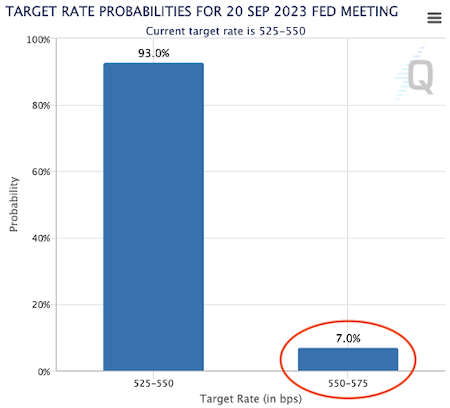

According to the CME FedWatch Tool, the chances of a rate hike are only 7%.

It’ll be a fun day at the markets if Powell and Co. surprise them!

Who’s Really Getting Hurt?

I’ll give you a hint. I’m typing from there.

But even better, let me give you this little ditty the incomparable Tom Luongo wrote on his blog, Gold Goats ‘N Guns:

While everyone is talking de-dollarization, the real currency losing its position in global trade is the euro. But no one is talking about de-euroization. I guess it doesn’t roll off the tongue as well.

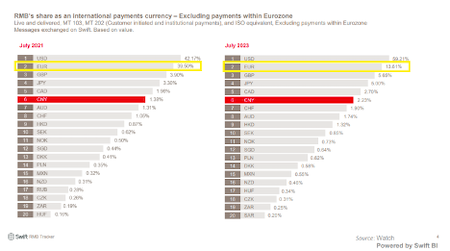

According to the latest data from the SWIFT RMB Tracker, there is no currency that has lost more ground in global trade than the euro. In just over two years, the euro has fallen from 39.5% of global payments outside the eurozone to just 13.6%.

The dollar absorbed most of those payments, with the British pound, Japanese yen, and, yes, the Chinese renminbi taking up the rest.

So, the great distraction about de-dollarization is, in part, about paying no attention to the rapid demise of the euro and the emerging sovereign bond crisis that ECB President Christine Lagarde works every day to paper over.

You must remember the euro was a politicalproject meant to tie Germany and France into a death embrace so they couldn’t go to war anymore. The economic story fed to the public was complete poppycock. Read The Tragedy of the Euro if you fancy more detail on that history.

The euro was never going to work. And now, we’re seeing just how fragile it is.

We also see how willing the US is to sacrifice Germany on the altar of neocon warmongering.

Do you really think Germany was worse off “depending” on Russian oil and gas? Right now, Germany looks like it will turn into the New European Rust Belt.

It makes one wonder why Europe treats the US like an ally. Perhaps it’s the over 60,000 US troops based there.

But even more disappointing are the BRICS and their “plan.”

BRICS Didn’t Make a Dent.

I thought the BRICS were a bit farther along the path of de-dollarization. But the truth is they didn’t develop their plan.

Luongo asserts this is because geography trumps currency.

As a fan of David Landes, I greatly sympathize with this argument.

But, back to the BRICS. If de-dollarization wasn’t the point of the Summit this year, then what was?

Expansion.

And not just expansion for the sake of expansion, but geographically strategic expansion.

The BRICS formally added six countries — Iran, Saudi Arabia, United Arab Emirates, Argentina, Egypt, and Ethiopia. They could have added others and almost added Algeria if not for a last-minute veto by India on behalf of France.

Algeria is symbolic of the fight between Italy and France for access to African oil and gas. There can be no Ital-exit from the EU without Italy minimizing France’s influence in North Africa, shoring up its energy needs as collateral for a return to the lira.

Thankfully, with the help of Russia and China, the Africans are taking care of the Italians’ French Problem all on their own.

If there is one common theme beyond the geography (more on that in a bit) with all six of these countries, it is their relationship with the supposedly former British empire. From the Arab states and Egypt to those that defied the Brits in the past — e.g., Iran and Argentina — these additions represent a power shift that is profound.

And while we wait expectantly for an alternative monetary system, we put our savings in USD.

Wrap Up

Imagine the irony: It won’t be a weak dollar that destroys the international monetary system. It’ll be a strong dollar.

A strong dollar that capital-hungry countries simply can’t pay back.

And while that locks countries into this system, for now, it easily explains why the Global South wants out so badly. China and Russia see the opportunity to offer an alternative but haven’t developed their plan enough.

So here we are, watching the Ascent of the Almighty.

Have a great day!