Posted December 10, 2025

By Sean Ring

A Sliver of Silver

It’s always lovely to see my good friend and colleague Alan Knuckman first thing in the morning when I check my Slack messages.

Alan wrote a simple “Good Morning Sean” in the editorial channel and posted a screenshot of the March Silver futures contract trading at 61.92. We actually got up to $62.14 in the futures before coming down below $62.

As the Brits would say, I was chuffed to bits to see the Devil’s Metal rallying so hard.

But as the spot (cash) price of silver is the bulk of the futures price, let’s switch to spot. That rose to $61.60 overnight and is trading around the 61 handle now.

In short, silver has officially broken out again, and depending on which charts you’re looking at, the next target is either $71 or $77. I’ll stick with $71 for now, and there it’ll take a breather. Once silver gets watered and fed, $102 is the next long-term price target.

But before we get all excited, let’s review the situation.

The Good News

After years of acting like gold’s nervous little brother, the metal has ripped higher in a way that even veteran metals traders are struggling to explain with a straight face.

Yes, the mainstream talking points are all there—tight supply, industrial demand, Fed cuts, geopolitical jitters—but this time feels different. This time, you can sense the market crossing a psychological threshold.

Industrial users who spent the last decade treating silver as an abundant afterthought are panicking. The refiners are scrambling.

And the bullion desks who suppress volatility with paper, are covering their shorts. The spot market, the futures curve, even the shadowy over-the-counter flows are all flashing the same message: silver has gotten away from us.

In times like these, silver doesn’t rally; it escapes. And historically, when it escapes, it drags an entire sector along with it.

Silver Is Up… Way Up

The run from the high $40s into the $60s has carried the unmistakable hallmarks of real demand. Not the ETF tourist flows or speculative froth, but genuine industrial and sovereign accumulation.

Solar manufacturers are paying whatever the market asks. Defense contractors are whispering to suppliers that they’ll eat the cost overruns.

The truth is, we’re entering the phase where silver does what silver has always done in tight regimes: it tries to find the price at which someone… anyone… volunteers to sell.

So far, very few are volunteering.

The Miners Are Coiling

Miners lag until they don’t. They trade sideways… and then they rally so hard a meandering portfolio becomes generational wealth.

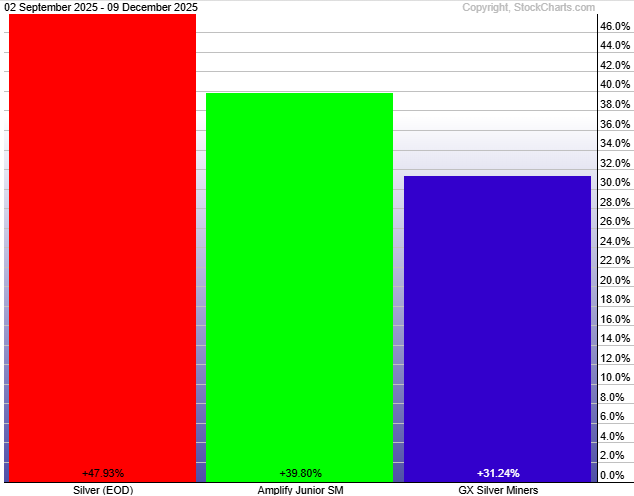

Right now, the miners look like a beach ball held underwater. Since September 2, spot silver has led the way, rising 47.93%. The juniors earned 39.80%, while the big miners appreciated 31.24%. This order of affairs will change soon.

Miners’ costs have stabilized. Margins are expanding. Cash flow projections are starting to look like they belong to a real industry again, not a punchline. And the institutional allocators who always show up two drinks late to the party are circling.

When silver holds above key support levels, the miners typically start fluttering. But when silver breaks out decisively, as it just has, the miners don’t flutter. They detonate.

The juniors, especially those with real grades and geology, are the most asymmetric trade in the entire metals complex. And finally healed from a decade of underinvestment, the producers are positioned to deliver operating leverage the S&P hasn’t seen in decades.

This is a coiling phase. It rarely lasts long.

The Worrisome Part of This Rally

Now, let’s follow Charlie Munger’s sage advice and invert: Why might silver’s move not be healthy?

A steady, orderly rise would tell us the market is adjusting to new fundamentals. But this isn’t orderly. It smells like fear. It feels like a squeeze. And it carries the subtle warning that the plumbing behind the scenes is clogging up.

When industrial buyers panic, that’s one thing. When bullion banks panic, that’s another. But when governments and defense contractors start panic-buying, that’s when you know something deeper is breaking.

Silver is a strategic input. Solar, electronics, high-end optics, medical tech—everything modern relies on it. And the military is a disproportionately large consumer. If you want munitions, you need silver. When that ecosystem shows distress, the whole geopolitical chessboard wobbles.

Which brings us to two uncomfortable realities…

The Military Industrial Complex

The defense world is sweating bullets over silver.

Modern weapons systems use far more silver than the average investor appreciates. Radar, guidance packages, secure communications, energy systems, directed-energy platforms, satellite components… silver is baked into all of it.

And the Pentagon doesn’t like uncertainty in its supply chain, especially not during an era as unstable as this one.

You don’t have to wear a tin foil hat to see what’s happening. When procurement officers start locking in metal at any price, they’re not trading. They’re bracing. They’re afraid of being caught flat-footed if the next geopolitical shock sends silver into a true runaway rally.

If the market keeps tightening, expect the defense sector to start quietly hoarding. They did it with rare earths. They did it with titanium sponge. And now they’ve classified silver as a critical mineral.

That didn’t calm prices. It poured gasoline on them.

Bullion Banks Are Bleeding

This is the part that should make every metals investor sit up straight.

Bullion banks aren’t supposed to lose control. Their entire business model is built on managing flows, nudging price, arbitraging paper against physical, and ensuring the market never breaks into chaos.

But the footprints right now suggest stress—maybe severe stress. It’s perhaps no wonder that JPM fell nearly 5% yesterday.

Silver lease rates are still elevated versus normal, with very short tenors reportedly in the mid-teens to several tens of percent annualised, compared with a long‑run “normal” well under 1% per year.

Deliverable inventories on major exchanges are shrinking at a pace we haven’t seen since the 2011 squeeze.

And the usual liquidity providers are stepping back because the spreads are too unpredictable to quote safely.

When a bullion bank bleeds, it doesn’t show up on CNBC. It shows up in the market microstructure. Banks that normally dominate the market start behaving like they’re afraid of taking the wrong side of the trade.

If silver keeps rising in this jagged, disorderly pattern, someone is getting crushed behind the curtain. And once a bank is cornered, the problem is no longer price volatility, but systemic risk.

And speaking of systemic risk, right now, an ounce of silver ($61) is worth more than a barrel of oil ($58.50). That isn’t normal. When this historical anomaly happens, either silver crashes or oil soars, or both.

Wrap Up

Silver’s rise is thrilling, profitable, and long overdue. But it’s also a warning. Markets don’t behave like this unless something in the machinery has snapped.

Enjoy the move. Participate in it. But don’t mistake it for a peaceful repricing.

Silver is telling us a story, and we’re in the early chapters.

WAR! What’s It Good For?

Posted March 02, 2026

By Sean Ring

The Biggest RINO of Them All

Posted February 27, 2026

By Sean Ring

Sports, Predictions, and Morons

Posted February 26, 2026

By Sean Ring

SOTU or STFU?

Posted February 25, 2026

By Sean Ring

Building an AI-Proof Portfolio

Posted February 24, 2026

By Sean Ring