Posted April 10, 2025

By Sean Ring

A Sea of Green

When portfolios are down 30% over a few days, investors find religion. Yesterday, their prayers were answered.

Many a clenched buttock relaxed on Wall Street, Main Street, The City of London, and anywhere else where people were holding their stock positions and hoping The Donald would grant them a reprieve.

And grant investors a reprieve, The Donald did, whether the bond market forced him to or not.

Nick Timiraos, better known on The Street as “Nikileaks,” summarized where things stand a week after Liberation Day:

- Tariffs on China will go to 125% from 104% on Wednesday and from 20% on Tuesday.

- Tariffs on all other countries (except Russia, North Korea, and Belarus) will be at 10% for the next 90 days.

- Tariffs on steel and aluminum are 25%.

- Tariffs on imported cars are 25%.

- Canada and Mexico face tariffs of 25% on goods that aren't eligible for USMCA.

However, the big news is that President Trump has paused retaliatory tariffs for 90 days. Treasury Secretary Scott Bessent emerges as the story’s hero.

Let’s unpack everything and imagine how things will be going forward.

The Plan

To review what I’ve written about this, Trump and Bessent target the 10-year yield, not the stock market, as a benchmark for economic success.

They want the 10-year yield to fall to make it easier for consumers and businesses to borrow money. The 10-year yield influences mortgage, credit card, and business borrowing rates. It also allows the USG to refinance that $7 trillion of US Treasury debt Janet Yellen left for Trump, like a flaming turd on the White House doorstep.

The best way to move money into the bond market (driving prices up, and thus, yields down) would be to purposely tank the stock market, as most people would “fly to safety” in U.S. Treasury bonds.

The tariffs were a way to spoof the market, and it worked—at least for the first few days. Stock markets worldwide puked, and the 10-year yield fell to 3.86% from 4.35%.

The Bond Market

But the “bond vigilantes” didn’t like this so much.

The “bond vigilantes” are bond market investors who sell off government bonds when they believe a government's policies are inflationary or irresponsible. Selling bonds drives up yields (since bond prices and yields move inversely), effectively raising borrowing costs for that government.

Ed Yardeni coined the term in the 1980s. He likened these investors to vigilantes in the Old West: when the sheriff (i.e., central bank or government) couldn’t keep fiscal order, the vigilantes stepped in.

From that low of 3.86%, the 10-year yield has rallied to 4.513% before settling at 4.3% this morning.

And this is where we move into the realm of speculation.

I imagine U.S. Treasury Secretary Scott Bessent took the President aside and told him what’s what. The bond vigilantes have rejected “The Plan.” We know that because yields have spiked, rather than fallen. Let’s take what the market has given us. Pause the retaliatory tariffs for 90 days, except on China, which retaliated against us. Smack them in the mouth. Keep the rest at 10%, except for a few different cases. Claim victory, because now we know the world is on our side. How do we know that? No one took China’s side. And you know what? When you announce this, the stock market will rally hard.

I can’t be sure that’s what happened, but I’ll wager it’s pretty close to the truth.

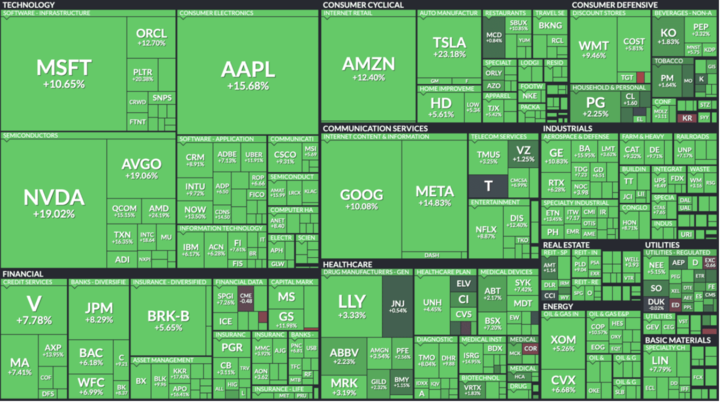

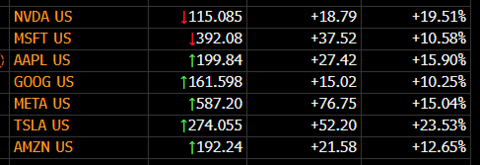

The Stock Market’s Reaction

Good friend and Paradigm editor Enrique Abeyta posted this in our Editorial Team Slack channel yesterday:

He noted it’s the second biggest percentage move ever in the Nasdaq.

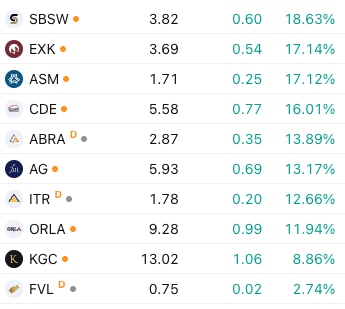

My miners also recovered nicely, though not the entirety of their losses (yet):

The SPX closed up 9.51% and the Nasdaq closed up 12.02%.

Don’t expect that to continue today, as many traders are taking profits. The SPX futures are down 1.45% and the Nasdaq futures are down 1.80%. This downward move is typical after a day like yesterday.

Gold is back up to $3,120, and silver trades around $31 this morning.

Going Forward

Here we can imagine how this will play out over the coming months.

Will enough trade deals be cut for the 90-day pause to become obsolete?

Maybe. I can’t imagine Trump giving up his cards without getting exactly what he wants. But Bessent convinced Trump to pause on the tariffs because so many deals were lined up (about 75, with Japan at the front of the line) that this wouldn’t look like capitulation.

Will Trump and Bessent apply heaps of pressure on Jay Powell to cut short-term rates?

Yes. Even though we’re in a world of fiscal dominance (where monetary policy [The Fed] takes a backseat to fiscal policy [The Treasury]), there will be one more chance for Jay Powell to spike the punch bowl. I imagine that since the 10-year yield gambit didn’t quite work this time, all the more pressure will be placed on Powell to “do the right thing” and cut rates.

Will the stock market continue its ascent?

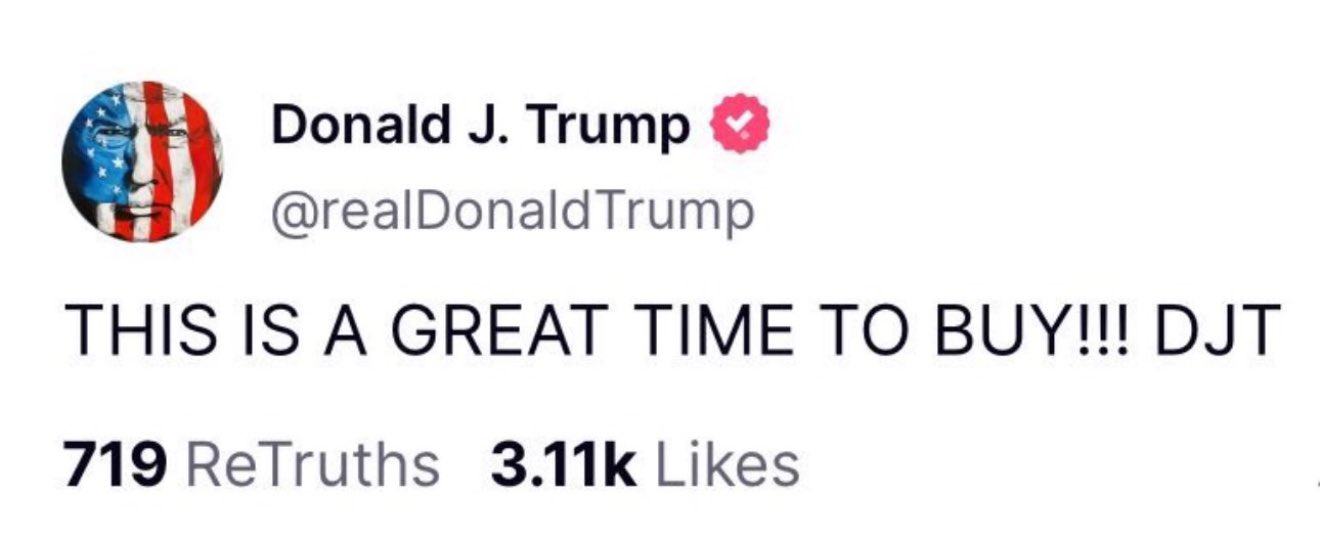

As I mentioned above, it’ll take a breather today to absorb those abnormal profits from yesterday. But The Donald posted this on his TruthSocial account:

The last few times he said that, they were great times to buy.

Wrap Up

Trump has more leeway to get away with his Art of the Deal tactics because he’s got an experienced heavyweight like Bessent as his Treasury Secretary. Together, they make a formidable team. It looks like Trump will get what he wants from the trade negotiations. After that, who knows?

We may even have a peaceful summer.

Have a great day ahead!

METALS MELTDOWN!

Posted January 30, 2026

By Sean Ring

Trump’s Victory at Sea

Posted January 29, 2026

By Byron King

Thank You, Mr. President!

Posted January 28, 2026

By Sean Ring

Silver Shellacking

Posted January 27, 2026

By Sean Ring

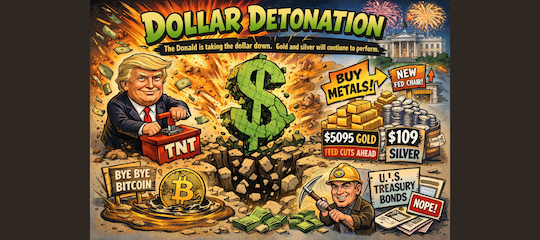

Dollar Detonation

Posted January 26, 2026

By Sean Ring