Posted May 20, 2024

By Sean Ring

A Nickel For Your Thoughts?

Thanks to Bidenflation, your thoughts are now five times more expensive than they used to be. One can harken back to the days of yesteryear, when Ingrid Bergman’s Ilsa Lund offered Humphery Bogart’s Rick Blaine a franc for his thoughts in Casablanca.

Rick answered, “In America, they’d only bring a penny. I guess that’s about all they’re worth.”

Well, Rick, eighty years later, you’ve got a raise! It’s nominal, not real. Nominal is the economist’s preferred word for “illusory.”

Oh, I’m not being serious. Since the creation of the Federal Reserve in 1913, the dollar has lost over 95% of its value. Pennies are practically worthless.

But nickel is on a tear. No, not the ones in your pocket. The metal that’s used to make stuff.

Let me catch you up on this critical element.

The Metal that Shapes the Modern World

What is nickel?

Nickel, a lustrous silvery-white metal, has been known since antiquity but was often confused with other metals like silver. Its history dates back to 1751 when Axel Fredrik Cronstedt, a Swedish chemist, isolated it while attempting to extract copper from a mineral known as niccolite. Cronstedt named the new metal "nickel" after the German word "kupfernickel," which translates to "devil's copper" due to the deceptive nature of the ore.

Where is Nickel Found?

Nickel, a critical element, is primarily found in two types of ore deposits: laterite and sulfide deposits. The major nickel producers are countries with abundant lateritic ores, such as Indonesia, the Philippines, Russia, New Caledonia (we’ll get to them later), and Canada.

Indonesia and the Philippines alone account for over 40% of the global nickel supply, a significant contribution driven by their rich lateritic deposits.

Nickel’s Applications

Nickel's resistance to corrosion and ability to alloy with other metals make it invaluable in various industries. Here are some key applications:

- Stainless Steel: About 68% of the world’s nickel production manufactures stainless steel, enhancing its strength and corrosion resistance.

- Batteries: Nickel is a critical component in the production of rechargeable batteries, especially nickel-cadmium and nickel-metal hydride batteries. More recently, nickel's role in lithium-ion batteries has surged due to the growing demand for electric vehicles (EVs).

- Plating: Nickel plating is widely used to provide a protective coating for other metals, improving their resistance to corrosion and wear.

- Alloys: Nickel alloys are essential in aerospace and military applications due to their high-temperature resistance and durability.

- Coins: Various countries use nickel in coinage due to its durability and resistance to tarnishing.

Nickel in the World Economy

Nickel is pivotal in the global economy due to its extensive use in stainless steel and battery production. The metal is crucial for infrastructure development, automotive manufacturing, and the burgeoning EV market.

The push towards green energy and sustainable technologies has further amplified nickel's importance. As countries strive to meet climate goals, the demand for nickel-rich batteries continues to rise, positioning the metal as a cornerstone of the energy transition.

The LME Nickel Episode of March 2022

In March 2022, the London Metal Exchange (LME) witnessed one of the most dramatic events in its history, centered around nickel trading. The episode was triggered by a massive short squeeze involving Tsingshan Holding Group, a major Chinese nickel producer. Tsingshan had built substantial short positions in nickel, betting on falling prices.

However, geopolitical tensions, including the Russia-Ukraine conflict, exacerbated supply concerns and sent nickel prices soaring. On March 8, 2022, nickel prices surged over 250% within hours, briefly touching $100,000 per metric ton, a historical high. This unprecedented spike forced the LME to halt trading and cancel billions of dollars' worth of trades to restore market order.

The LME's intervention sparked controversy and debates about market integrity and the role of financial institutions in commodity markets. The exchange faced criticism for its handling of the situation, with some market participants questioning the decision to cancel trades. This incident underscored commodity markets' volatility and speculative nature, mainly when driven by geopolitical factors and supply chain disruptions.

Elliott Fund Management sued for $456 million, claiming that LME acted "unreasonably and irrationally" when it canceled those nickel trades made on March 8, 2022. Jane Street Global Trading sued LME for $15.3 million for the same reason.

The Hong Kong Exchange (HKEX) owns the LME.

Now, let’s get to more current events on the other side of the world.

A Crucial Player in the Nickel Industry

New Caledonia, a French overseas territory in the southwest Pacific Ocean, is renowned for its rich cultural heritage and diverse ecosystems. With its stunning beaches, coral reefs, and unique blend of French and Melanesian influences, it is a unique and vibrant place. However, due to its abundant nickel reserves, New Caledonia holds significant economic importance beyond its natural beauty.

Credit: https://www.newcaledonia.co.nz/new-caledonia-map/

Credit: https://www.newcaledonia.co.nz/new-caledonia-map/

Importance as a Nickel Miner

New Caledonia is one of the world’s leading producers of nickel, holding approximately 10% of the world’s known nickel reserves. The territory’s economy is heavily reliant on nickel mining, which accounts for a substantial portion of its GDP and exports. Major nickel mines such as the Goro mine and Koniambo Nickel project are central to global nickel supply, making New Caledonia a crucial player in the global market. The high-quality laterite nickel ore found here is essential for producing stainless steel and batteries, particularly as demand for electric vehicles rises.

Voting Rules Changes and the Recent Riots

New Caledonia has been experiencing significant political tensions, particularly surrounding its relationship with France. The recent riots against French rule were sparked by changes to voting rules related to the territory's independence referendums.

The changes that incited the riots include modifications to the electorate criteria for the independence referendums. Many pro-independence Kanak groups perceived these changes as favoring the loyalist (pro-France) side. Specifically, the eligibility criteria were seen to potentially dilute the influence of the indigenous Kanak population, which predominantly supports independence.

The changes led to widespread unrest and riots, as the pro-independence factions felt that the alterations undermined their prospects of achieving a fair vote on the territory's future.

The Upshot

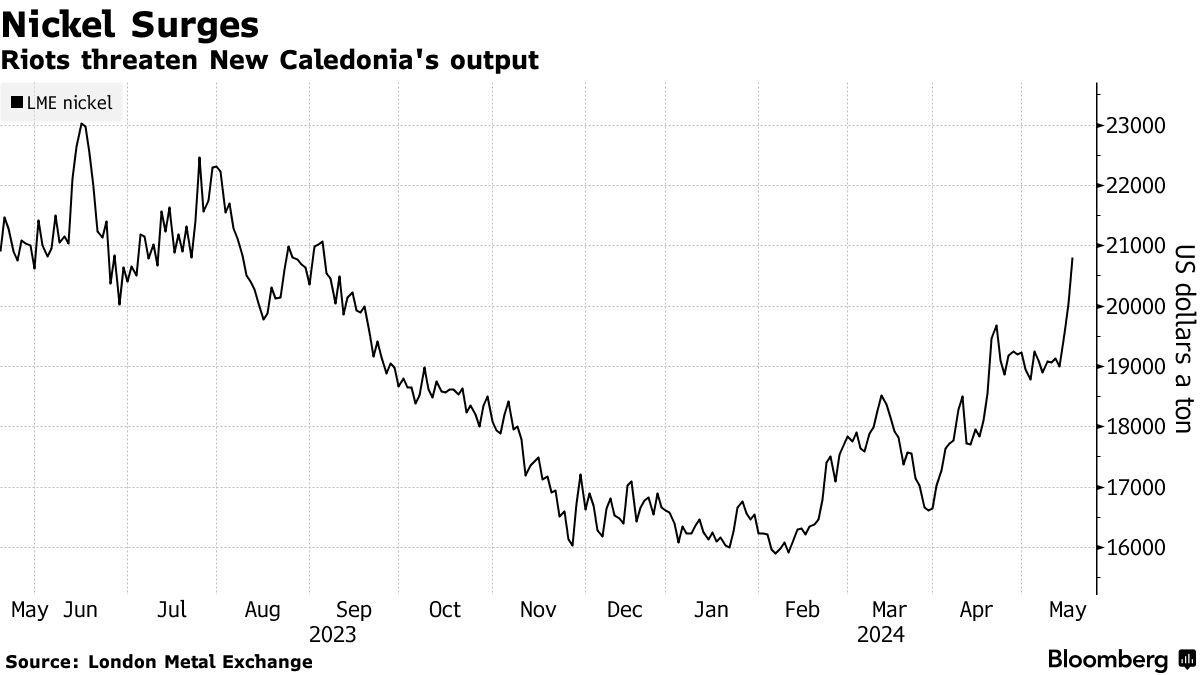

Between its importance and the tightening of its supply due to the New Caledonian crisis, nickel has had a surge in its market value.

Since February, we’ve rallied from $16,000 per metric ton to nearly $21,000. That’s a tidy 31.25% return in under four months. Year-to-date, only silver’s 32.35% return outpaced nickel’s 27% return.

Wrap Up

The commodity bull market is well underway, but far from over. More metals keep joining the party. As inflation heats up again, the Fed cuts rates in June or July, and supply tightens, we’re only looking for more of the same for the near future.

There’s still time to join the metals party. Take action.

Investing is So Taxing!

Posted February 19, 2026

By Sean Ring

The Most Expensive Way to Go Broke

Posted February 18, 2026

By Sean Ring

The Bears Gather

Posted February 17, 2026

By Sean Ring

Omar Khayyam: Poet, Rebel, Astronomer

Posted February 16, 2026

By Sean Ring

The Devil in Mexican Mining

Posted February 13, 2026

By Matt Badiali