Posted October 03, 2025

By Sean Ring

A Minor Miner Correction

I’ll be the first to admit it.

When I saw the miners open yesterday, I experienced what former Manchester United manager and legend Sir Alex Ferguson called “squeaky bum time.” That’s the point in a football (soccer) game Americans would refer to as crunch time, eschewing the reference to the nervous sweat that develops between your ass cheeks.

My guys were down between 4% and 6% across the board, and the situation looked uglier than a drunk carpenter’s thumb. The USD Index had rallied up to 98.13, dampening the metals and miners’ rally.

After I took a few deep breaths, I calmed down immediately, thinking, “It’s not that much of a dollar rally,” and remembering I still owed Alan Knuckman dinner in Nashville next week. Alan had won a bet ages ago, saying the dollar would break below 100 before it’d hit 115. And thanks to Donald Trump, he was right! It’s nearly time to pay up.

By the end of the trading session, my portfolio, stuffed to the gills with miners, was down a minuscule 1.6%. I shook my head, thinking, “Thank heavens your body chemistry makes you too old and too slow to make rash moves!”

To sum it up, yesterday’s down session was the perfect elixir to the raging, hyperbolic move we’ve seen in the miners lately.

Let’s break down why.

Mr. Slammy Has No Power Here

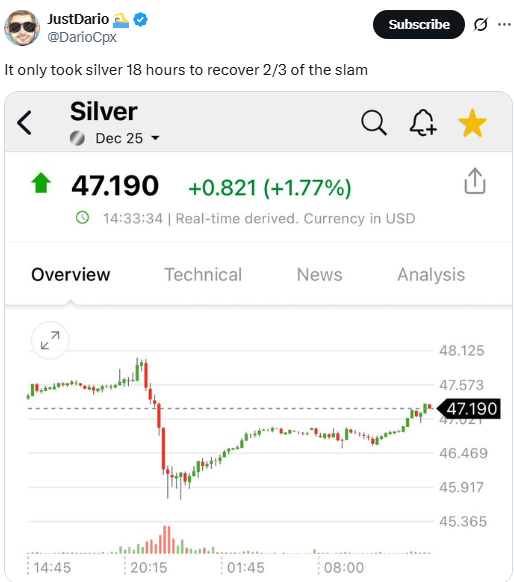

First, we had this:

Then we had this:

Mr. Slammy doesn’t have nearly the power he used to. There are far too many Western and Asian buyers for him. The recoveries are coming thick and fast.

As I write, silver is trading at 47.35.

The Big Box Banks Have Finally Caught On

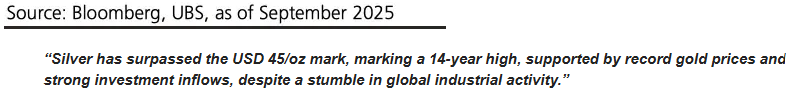

It always takes the banks a while to change their positions (especially since they’ve been so wrong for so long), but they have finally changed their stance on metals.

Credit: Zero Hedge

Credit: Zero Hedge

Also from Zero Hedge:

UBS has aligned its silver projections with its recently upgraded gold outlook from September 11. The bank now targets USD 44–47 per ounce by mid-2026. Analysts also see silver outperforming gold as monetary easing takes hold and industrial demand recovers, with the gold-silver ratio potentially falling closer to 80.

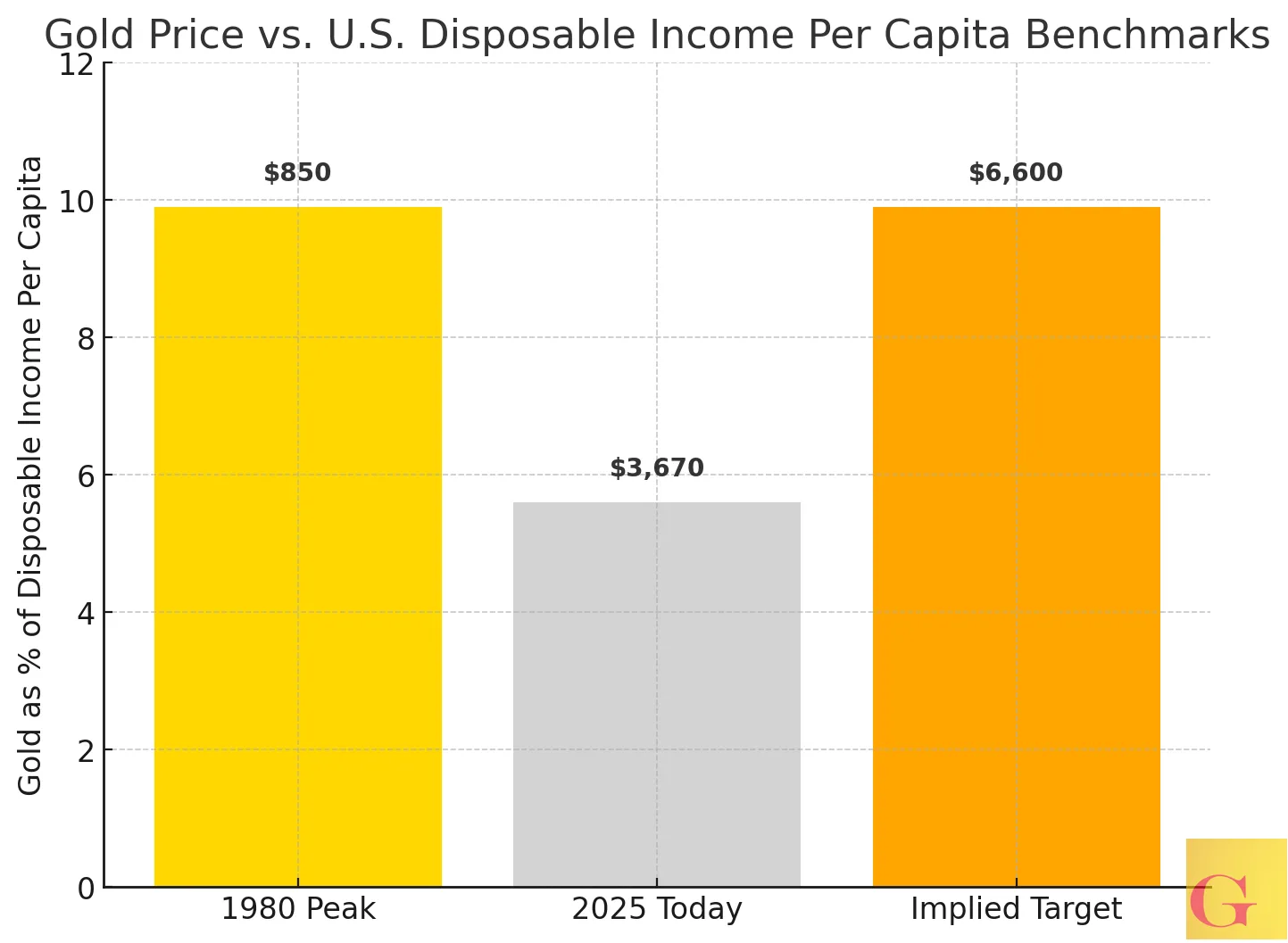

Jefferies, another big bank, puts the gold target at $6,600. Their thinking is that in 1980, the $850/oz. The gold price was 9.9% of disposable income. If we apply that same logic to today, 9.9% of disposable income equals $6,571.

Credit: Zero Hedge

Credit: Zero Hedge

Moreover, if we applied the same math but used M2 instead, the target price would be a whopping $11,900.

The Gold Rally is Going Mainstream

Former PIMCO fund manager and Harvard Endowment head Mohamed El-Erian quoted CNBC a report that said J.P. Morgan analysts are calling the gold and Bitcoin buying phenomenon “the debasement trade.”

What would we do without these guys?

Seriously, how long have we at Paradigm talked about debasing the dollar?

I have to admit, I love Michael Saylor, Strategy’s CEO and Bitcoin enthusiast, calling him out on it. Saylor had better pray that coiners don’t use their proceeds to buy gold, or he will be bankrupt.

Besides that, all the housewives who still watch CNBC will now be aware that gold and silver are the places to be.

Trump’s “Grow Out of Debt” Plan Means Higher Inflation

In an exclusive interview with OANN yesterday, President Trump said the following (bolds mine):

With the kind of growth we have now, the debt is very low, relatively speaking. You grow yourself out of that debt. The numbers we have now are bigger than they ever were. We also might make a distribution to the people.

We’re thinking almost $1,000 to $2,000.

Needless to say, this plan is loco. Debt is ludicrously high, and getting worse, thanks to the deficits he’s running.

If anything, The Donald needs to stop spending money so lavishly. Handing out stimulus checks willy-nilly was what caused the CPI, an already flawed metric that underestimates inflation, to rise to nearly 10% under Joke Biden’s presidency.

This reason alone is reason enough to hang on to your gold, silver, and miners' positions for the foreseeable future. Now is not the time to be taking profits on your long-term positions.

Wrap Up

Asian buyers have neutered Mr. Slammy. The banks have caught onto the metals trade.

The gold rally has all sorts of heightened price targets. The President has decided to abandon any semblance of fiscal discipline.

The evidence is overwhelmingly in favor of an extended rally in gold, silver, platinum, palladium, and a wide range of other metals and miners.

In this once-in-a-lifetime situation, stay long or stay wrong.

Have a wonderful weekend!

$50 Silver: Ceiling or Floor?

Posted October 02, 2025

By Sean Ring

Equities and Metals Soar in a September to Remember

Posted October 01, 2025

By Sean Ring

Keep These Things In Mind When Riding the Wave

Posted September 30, 2025

By Sean Ring

Pennies and Steamrollers

Posted September 29, 2025

By Sean Ring

Blue Orca Hates Aya Gold & Silver

Posted September 26, 2025

By Sean Ring