Posted December 19, 2024

By Sean Ring

A Drugged Market’s Withdrawal

Mr. Market will need a Bloody Mary to recover from yesterday’s blood-red day across the border. Jay Powell’s Fed told the market that in 2025, it can expect fewer cuts (2) than initially thought (4). Like a spoiled child, Mr. Market took a dump in his diapers in the middle of a packed mall.

But before I go on, I’ve got a special announcement!

Tomorrow is my 50th birthday, and I’m joining my friends Paradigm Grand Poobah Matt Insley and the hardest working man in the newsletter business, Rickards Senior Analyst Dan Amoss, on RickardsUncensored at 10 a.m. ET. In return for working on my birthday, I asked that the entire Rude Remnant join the call free of charge, and Matt happily agreed! Here’s your link.

We’ll talk about why the Fed’s hawkish “dot plot” was so damaging, the overall markets, our outlook for 2025, and much more. I hope to answer a few more questions Rude Readers have also sent in lately. So, if you have the time to spare, join us at 10 a.m. tomorrow by clicking here.

Before summarizing yesterday’s events, I must remind you that Donald Trump can announce it’s time to buy stocks anytime. Remember how he did that around Christmas in 2018, leading to a big market rally?

I have to remind myself that “blood” in Italian is “sangue,” from which the English word “sanguine,” meaning “optimistic,” comes.

What Happened?

Yesterday, U.S. markets fell out of bed after the Federal Reserve announced its widely expected 25 basis point rate cut, bringing the federal funds target range to 4.25% to 4.5%. Despite the entire market knowing this cut was coming, the Fed indicated a slower pace of rate reductions was coming in 2025. This caught investors off guard, leading to a sharp market downturn.

The S&P 500 dropped 2.9%, marking its second-worst loss of the year. The Dow Jones Industrial Average plummeted over 1,100 points, extending its losing streak to ten consecutive sessions—the longest since the year of my birth(!), 1974. The tech-heavy Nasdaq Composite was taken out behind the woodshed, falling 3.6%.

Powell emphasized the need for caution in future monetary policy adjustments in his press conference, citing persistent inflation concerns and a robust labor market.

Of course, this begs the question: If the Fed has persistent inflation concerns and the labor market is robust, why is it cutting rates at all?

I fear only future economic historians will be able to answer that question.

The Fed's revised projections now suggest only two rate cuts in 2025, down from the four anticipated earlier. This suggests a more measured approach to achieving the 2% inflation target. Honestly, I’m not sure the Fed will get anywhere near that number next year without the market crashing and unemployment rising to over 6%.

This unexpected Fed shift spiked Treasury yields and strengthened the dollar, putting more pressure on equities. Investors who had been optimistic about a more aggressive easing cycle sold stocks in droves.

Now, let’s look at some charts.

The Charts

A quick note: although the charts below are in the same format as the monthly asset class report, they are daily charts, not weekly ones.

The 10-Year Yield

The Fed cut short-term rates yesterday, but the most important long-term rate in the world spiked 11.5 basis points because of expectations about future cuts. This is not good. Jay Powell is behind the curve, as usual.

The Dollar Index

As rates increase, the dollar keeps getting mightier. We got above the 108 handle before pulling back. The stronger the dollar, the fewer you need to buy stuff.

The Long Bond

Persistent inflation concerns will get you a long bond falling out of bed. I don’t like bonds here at all. They got crushed yesterday, as well.

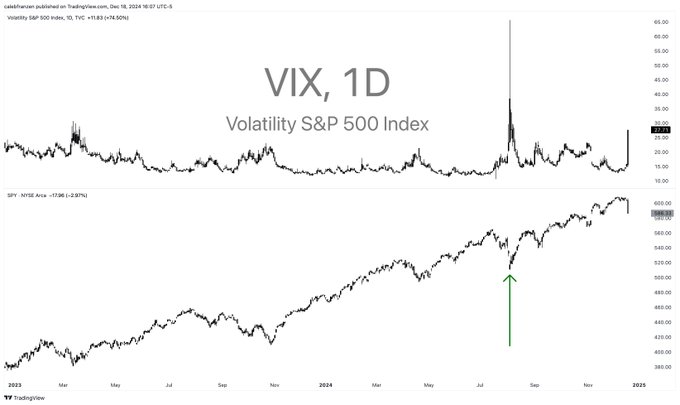

The VIX

The VIX - the market’s fear gauge - popped over 74% yesterday. According to analyst Caleb Franzen, the good news is that the last time the VIX spiked over 60% was in August (on the left side of the chart). The SPX went straight up after that.

Credit: @CalebFranzen

Credit: @CalebFranzen

The SPX

You can argue we’ve entered into a short-term bear market with the SPX falling below its 50-day moving average, but I’d hold my horses. Let’s see the follow-through today.

The Nazzie

It was an awful day, for sure, and it may presage more to come. But let’s keep our heads about us first.

The Russell 2000

Again, it was a bad fall (down 4.43% on the day), but we need to see where it goes from here.

Oil

Oil wins “Meh Chart of the Year.” It’s more “meh” than anything I’ve ever seen.

Gold

Okay, look at that last candle. Yesterday, gold fell to $2,600 but rebounded to close at $2,653.30. I’m optimistic it will soon challenge and retake the $2,800 level.

Bitcoin

Bitcoin got crushed yesterday, as well. But it’s recovering this morning, which is a very good sign.

Wrap Up

Don’t panic. Yesterday was uglier than a hatful of cornholes, but it’s no time to panic sell. Before making big selling decisions, let’s see how the market reacts over the next few days. After this dust settles, you may not want to sell at all.

And remember tomorrow, Dan Amoss will be on Rickards Uncensored with Matt Insley and me to discuss the Fed’s hawkish dot plot and why it was so damaging. Click here to join.

Have a great day!